It’s always a shame when fresh and interesting prospects are unable to acquire funding. That’s why we were so happy to help one of our recent clients, who was struggling.

The company had sought funding from high street lenders in the past, but were rejected through no fault of their own, and had come to the end of their tether by the time they met with us.

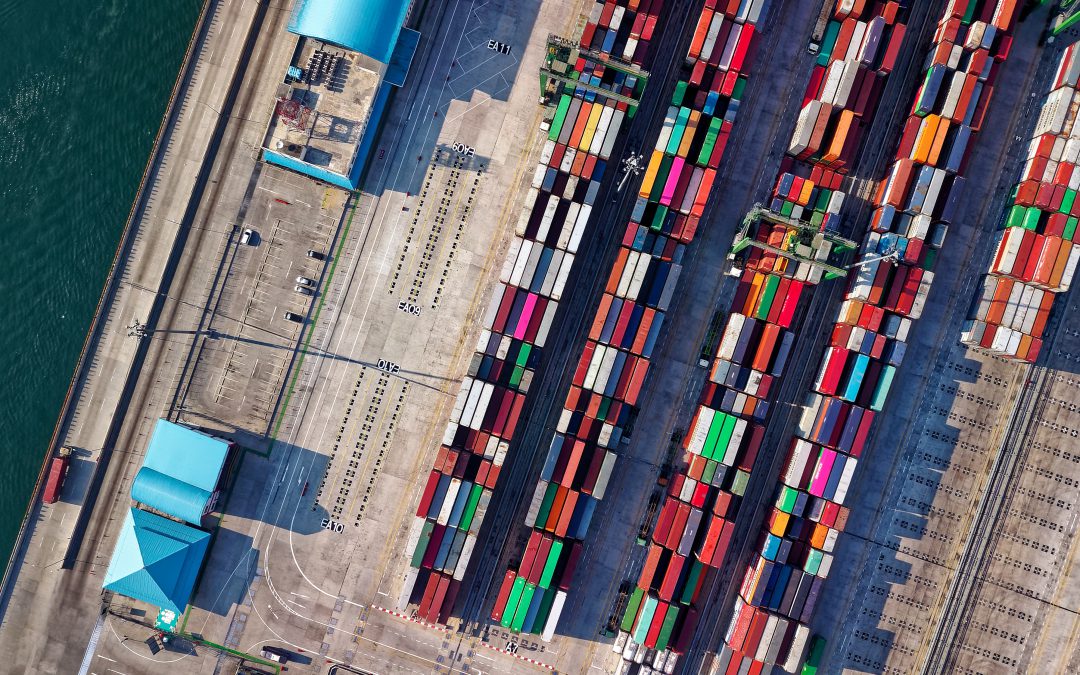

The company operates in international trading, which is an industry we are very familiar with. As such, we took this deal on with confidence that we could find this company the ideal facility.

After scouring the market, we managed to arrange a specialist factoring facility where the company’s suppliers receive a letter of credit when their stock is ready to ship. This took a lot weight off their shoulders, and allowed them to keep their cashflow doing just that – flowing.

Factoring is an incredibly useful tool that allows clients to bridge the gap between completing jobs and receiving payment, thus allowing them to keep both their customers and their suppliers happy without being stretched too thin. Find out more about invoice finance here.

Recent Comments